Investment Opportunities

- Home

- »

- Investment Opportunities

Investment Opportunities Analysis and Evaluation

Why is Investment Opportunities Analysis Important?

Informed Investment Decisions: The study of investment opportunities provides essential information that helps investors make data-driven decisions instead of relying on guesswork. Through comprehensive analysis, investors can identify opportunities that align with their investment strategies and financial goals.

Identifying Growth Potential and Real Profits: Investment opportunity analysis doesn’t only focus on economic feasibility but also on estimating future growth and profit potential. This helps in understanding the ability of the opportunity to generate the desired returns and how it might affect the investment portfolio.

Risk Mitigation: Through precise evaluation, potential risks associated with each investment opportunity can be identified. This helps in developing strategies to manage risks and reduce their impact on expected returns, improving the chances of long-term success.

Well-Considered Implementation Strategies: The study of investment opportunities extends beyond theoretical analysis to include the development of effective execution strategies. This involves creating clear and defined action plans to make the most of investment opportunities while avoiding potential issues.

Balancing Returns and Risks: Through in-depth analysis, investors can achieve a balance between the potential returns and the risks associated with each opportunity. This balance is crucial to ensuring positive outcomes while maintaining an acceptable level of risk.

The Investment Opportunities Analysis and Evaluation service ncludes the following elements:

Market and Trend Analysis

Financial Evaluation of Investment Opportunities

Economic Feasibility Study

The economic feasibility study provided by Value is a comprehensive service aimed at evaluating all economic aspects of an investment project or a new opportunity to ensure its success and the achievement of targeted returns. This study offers an in-depth and thorough analysis of various factors that may affect the project, while providing strategic solutions to ensure its sustainability and long-term success.

The elements of the economic feasibility study offered by Value include:

Market Analysis: Studying the market position of the project, determining the levels of supply and demand, analyzing competitors, and identifying future market trends.

Cost and Revenue Analysis: Estimating the costs associated with project implementation in terms of resources, manufacturing, operations, and marketing, along with analyzing expected revenues.

Financial Return Analysis: Calculating the return on investment (ROI) and assessing the financial feasibility of the project using financial indicators such as Net Present Value (NPV) and Internal Rate of Return (IRR).

Financial Risk Assessment: Identifying the financial risks associated with the project and offering strategies to manage and minimize negative impacts.

Investment Planning: Developing a detailed plan for managing and investing funds efficiently, including defining how the project will be financed and identifying any additional funding requirements.

Risk Assessment and Management

The risk analysis service offered by Value is designed to evaluate and analyze all potential risks that a project or investment opportunity may face, in order to identify effective ways to minimize and manage them. This analysis focuses on various types of risks that may impact operations and financial outcomes, including financial, operational, environmental, and social risks.

The key components of the risk assessment service provided by Value include:

Financial Risks: Analysis of risks related to fluctuations in financial markets, such as interest rate volatility, inflation, and exchange rate changes. We provide strategies to mitigate the negative effects of these risks on the project.

Operational Risks: Identification of risks associated with the operational performance of the project, such as production issues, resource shortages, supply delays, or technical failures in technological systems.

Legal and Regulatory Risks: Assessment of risks linked to local and international laws and regulations that could affect operations, such as changes in environmental or tax legislation, ensuring the project complies with all legal requirements.

Environmental and Social Risks: Evaluation of the potential environmental and social impacts of the project, including effects on the environment or local communities. We develop solutions to minimize these impacts and support the project’s sustainability.

Strategic Risks: Assessment of risks related to the overall strategy of the project or future market trends, including risks from changes in competition or the entry of new market players.

Investment Advisory

The investment advisory service offered by Value is designed to provide specialized guidance to individuals and businesses seeking to make well-informed and effective investment decisions. This service includes analyzing available opportunities across different markets, offering investment strategies aligned with the client’s goals and financial profile, and assisting in making decisions that aim to maximize returns while minimizing risks.

Key elements of the investment advisory service provided by Value include:

Investment Opportunity Analysis: Evaluation of investment opportunities in various markets such as stocks, real estate, business ventures, or alternative investments, with a focus on expected returns and associated risks.

Portfolio Diversification: Offering strategies for diversifying the investment portfolio to reduce risk and maintain a balance between long-term returns and short-term risks.

Financial Goal Setting: Assisting clients in defining their short-term and long-term financial goals—such as retirement, education, or real estate purchases—and achieving them through tailored investment strategies.

Investment Risk Management: Analyzing potential risks that could impact investments, such as market volatility, economic shifts, or political uncertainties, and offering strategies to mitigate these risks.

Continuous Monitoring and Adjustment: Providing ongoing support to monitor investment performance and adjust strategies in response to market changes or shifts in the client’s financial objectives.

Start Your Dream Project Now with a Specialized and Professional Company

The First Stage with Value

Project Implementation

Contracting with the Client

Sending a Price Proposal

Agreeing on Service Elements

Project Discussion

Receiving the Request

Project Execution Phase

Holding a Meeting

Data Collection

Submitting the Report to the Executive Team

Service Execution

Sending the First Draft

Meeting to Explain the Service

Final Feedback

Final Project Delivery

Follow-up and Technical Support

Feasibility Study Components Provided by Value

Executive Summary

Marketing Study

Environmental and Social Study

Administrative and Organizational Study

Technical Study

Financial Study

Economic Feasibility Evaluation

Final Decision

Consultant Recommendations

Latest Feasibility Studies

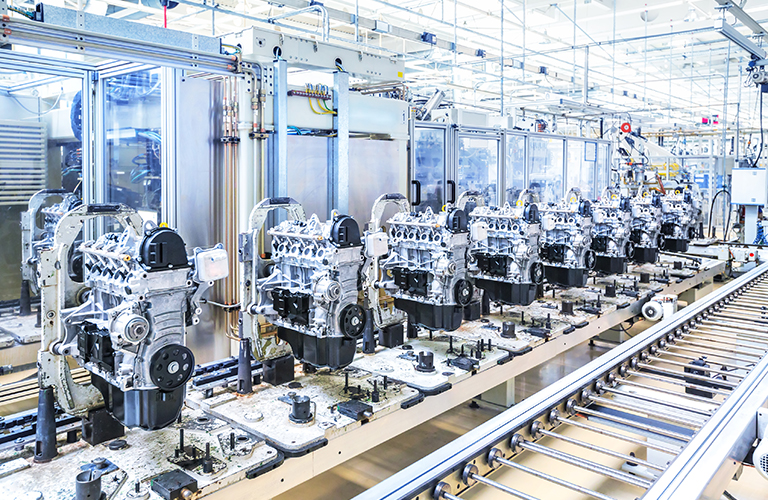

Fuel Pump Manufacturing Plant

- Return on Investment (ROI): 30%

- Capital Investment: 10 million SAR

Metal Wheel Manufacturing and Assembly Plant

- Return on Investment (ROI): 30%

- Capital Investment: 10 million SAR

Car Compressor Manufacturing and Assembly Plant

- Return on Investment (ROI): 30%

- Capital Investment: 10 million SAR

Poultry Industry

- Return on Investment (ROI): 30%

- Capital Investment: 10 million SAR

Latest Investment Opportunities

Five-Star Hotel Development Project in Asir Region

- Return on Investment (ROI): 10-12%

- Capital Investment: 5-10 million SAR

Glass Container Factory Project in the Northern Region

- Return on Investment (ROI): Not Specified

- Capital Investment: 8 million SAR

Luxury Wellness Resort Development in Riyadh

- Return on Investment (ROI): 10-12%

- Capital Investment: 1.31 – 1.69 billion SAR

Economic Zone Development Project in Jubail

- Return on Investment (ROI): 30%

- Capital Investment: 10 million SAR